Opening the paycheck this month may reveal a bump in pay courtesy the Trump administration’s tax changes.

“No one is going to get rich overnight due to the changes in their deductions,” said John Estess of Estess CPAs in Luling. “However, I am sure that the average family is going to be better off with the additional take home pay.”

Before ripping open the check, it’s best to know this will rely on an earner’s tax bracket because the break is coming from less federal deductions.

“With the lower tax rates in effect for 2018, there’s not a need to withhold at 2017 rates,” Estess said. “The rates with each tax bracket have been lowered and that is how taxpayers will see larger paychecks.”

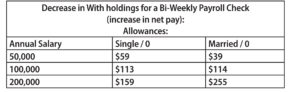

A single earner making a $50,000 annual salary will see a $59 decrease in withholdings for a bi-weekly payroll check (increase in net pay), according to Estess. For someone married in this tax bracket, the amount will be $39.

If the earner in this same pay period makes $100,000 and is single, the amount will be $113. If married, the amount will be $114. Someone single making $200,000 a year will see $159 more on their check compared to a married earner which will see $255.

If the earner in this same pay period makes $100,000 and is single, the amount will be $113. If married, the amount will be $114. Someone single making $200,000 a year will see $159 more on their check compared to a married earner which will see $255.

When this will occur depends on who is preparing the payroll.

But Estess said their clients’ employees are seeing the difference now.

There are no changes in Social Security and Medicare deductions. Estess said the change is coming from less deducted from the check.

Estess said two of the most common areas will come for those who itemize.

“You may take a medical expense deduction for all expenses above 7.5 percent of your Adjusted Gross Income,” he said. “For 2016, the medical deduction floor was 10 percent.”

He added, “For business property acquired and placed in service after Sept. 27, 2017, you may deduct 100 percent of the amount paid for the asset. Under the new law, this deduction may also be applied to used assets.”

As for the gains from this tax break, Estess recommended doing something wise with this money.

“I think it is important for taxpayers to do something wise with the additional net pay that they will be receiving,” he said. “It is always smart to save for the future, whether that is retirement, a rainy day, or college expenses. Since most people’s budgets are already built around their current pay, the extra amounts transferred to a savings account of any type will not even be noticed.”

Be the first to comment