Families from across St. Charles Parish poured into R.K. Smith Middle School in Luling on Monday for an open house introducing new flood zoning maps that will have a great impact on what some parish property owners will be paying in flood insurance rates.

Many of the 419 families in attendance left in dismay, some in tears, after finding they will be facing a heavy increase in flood insurance rates if the maps as currently proposed by FEMA go into effect as expected in 2014.

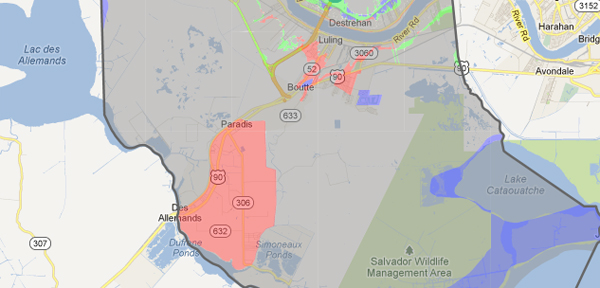

While many homeowners living on the East Bank of St. Charles are protected by a new levee and expect to see a decrease in their flood insurance, their West Bank neighbors have been left virtually unprotected and their flood insurance rates are fixing to increase dramatically because of it.

In particular, FEMA decided not to recognize the century old Sunset Drainage District levee protecting all of Des Allemands, Paradis and Bayou Gauche. Residents in those areas are expected to see a significant increase in their flood insurance rates many times over what they currently pay.

Juanita Guidry bought a home in Bayou Gauche in 1999 and said although she was not required to buy flood insurance because the Sunset Drainage District levee was recognized at that time, her family went ahead and did so.

“After Katrina when they redid the maps the first time, they put us in a flood zone and redid all of the elevations in the area,” Guidry said. “Being good responsible people and already buying our flood insurance, we were grandfathered in at the rate we were paying at $350 a year.”

Under the map that is now being proposed, Guidry’s flood insurance is estimated to rise to $15,000 a year.

“No one can afford $1,000 a month in flood insurance premiums and the mortgage companies are going to require it. They have to protect their investment,” she said. “I was just told I can’t sell my house ever. It’s gone.”

A neighbor of Guidry’s built a house in the area after the last flood maps were released in 2008 and met the requirements that were in place at the time. However, because the Sunset Drainage District levee has now been invalidated those requirements have changed.

“He had to build to the new elevations after Katrina, which was five feet above sea level,” she said. “He is now below their required level and is going to have to pay $8,000 a year for flood insurance…and he just built to their requirements.”

Bayou Gauche resident Cathy Porthouse burst into tears after being notified that her insurance could be as much as $18,000 per year.

“It seems to me that the very government that we look to protect us has the ability to create the very problems to justify their expansion,” she said. “They take our money. We try to be responsible, try to be a good homeowner and this is what they do to us.”

Porthouse stormed out of the open house wiping her tears away.

Rep. Greg Miller said the decision by the Corps of Engineers to not recognize the Sunset Drainage District is devastating.

“A lot these people are upset and for good reason,” he said. “They were told they needed their house at this elevation and they built their house higher than what FEMA told them they would need to. Now they are told that is not good enough. The rug is being pulled from underneath them and the rules are being changed in the middle of the game.”

If the maps are implemented in the current form, the areas with the largest increases in flood insurance are expected to decline drastically in property value.

“Your property is probably not worthless. But how can you sell your $200,000 house now that you have to tell somebody that the flood insurance is $5,000, $10,000 to $15,000 per year? Good luck with that,” Miller said. “I think people may be better off turning in their keys to the mortgage company and say to your mortgage company ‘it’s your problem.’”

In Luling and Boutte, flood insurance rate increases are also expected to rise in low lying areas.

Dale Brou said he was lucky to have built in the Mimosa Park area in 1959.

“That’s over 50 years ago so we are grandfathered in,” Brou said. “Of course Congress can change that.”

Some homeowners are “grandfathered” by their insurance companies, however congress plans to end the practice in the future.

Brou said although the new maps do not appear to have an effect on his property, he understands why so many people are upset with them. He points to a failure by government on all levels for not moving fast enough on the West Bank levee project, which has been in the works for decades.

“Why didn’t we have a levee built by the time Jefferson had theirs?” he said. “What happened to LaPlace now that St. Charles’ East Bank has a levee? Where did that water go from Lake Pontchartrain? It went into LaPlace. What’s going to happen to the water when it goes in to the St. Charles Parish line? It is going to come into us.”

The parish has been attempting to gain funding in any way possible to complete a West Bank levee that would protect Luling and Boutte. All permits for the levee have now been secured, but the parish is extremely short in funding. The completion of the levee is expected to cost $150 million.

For now, residents in those areas are afraid storm surge will spill over into their houses due to the newly constructed levee protecting Jefferson Parish’s West Bank and the town of Ama in St. Charles Parish.

Dale Seal, who lives near the Jefferson Parish line, said he has been frustrated with the lack of movement on the West Bank levee project. Although he attended the open house, he was not willing to wait in the long line of people trying to find out what their new insurance rates would be.

“It looks like we are being penalized for not having a levee even though we didn’t have any control over it,” he said. “I’ve been following what they’ve been doing and I’ve just been frustrated with how long it took them to get the right of ways to get it all done. And then when they get the right of ways, they tell me they don’t have all the funding for it when they get it done.”

Diana Deroche has lived in the Mimosa Park area for the last 54 years and her home has never flooded. Like Seal, she was unwilling to wait in the long line to speak to someone about her new insurance rate.

She said she is anticipating only a small increase in her insurance.

“If the insurance rates go up, I’ll have to accept it whether I like it or not,” Deroche said.

Greg and Linda Schultz, who have lived in the Willowdale subdivision for the past six years, said their insurance rates are anticipated to be 10 to 20 times higher than what they are right now.

“We are paying about $500 a year,” Greg said. “It could go to $10,000 because we are so many feet below that base elevation.”

The Schutlzs said they were recently thinking about selling their home, but they do not know if that is a possibility now.

“If I go to sell my house, which we are thinking of doing, the guy coming behind me is immediately going to go into $5,000 plus of flood insurance per year,” Greg said.

“He’ll be able to afford the house, but not the insurance,” Linda said.

Tony Perez was one of the fortunate few who attended the meeting. The Kenner resident owns a piece of land in Boutte where he is determined to build a home.

“I’ve got to get to minimum elevation. If I go a foot higher it will cut my insurance in half and I’m trying to see what that cost and benefit is,” he said.

Despite the recently proposed changes in the maps, Perez said he is undeterred in his plans.

“I am going to build there. We came out here for the school district,” Perez said. “We love the location and we love the neighbors and we’ve got to see how high we’ve got to go.”

FEMA representative Jackie Chandler said before the maps go into effect they will undergo a 90-day review in which residents will have a chance to appeal them.

She hinted that the appeal process will undoubtedly be difficult.

“The maps were developed with the most current and precise scientific data. So if they are going to appeal, their appeal needs to be from scientific data as well. It can’t just be ‘I don’t like the maps,’” Chandler said. “You actually have to show what that error might possibly be through scientific data.”

In the meantime, Miller said there is little he can do in his position as state representative. However, he says he will appeal to federal lawmakers and authorities to try and change what he believes is an impending economic crisis.

“These people’s property and livelihood are at stake and we need to try and get some resolution and solution in Congress or at the federal level,” Miller said. “People talk about the increase in the payroll tax and how that has affected people’s purchasing power. How about a $5,000 a year hit on people’s purchasing power?”

To find out how the new maps will affect your property, you can visit maps.riskmap6.com or call the Flood Smart toll free at (888)379-9531.

Be the first to comment